refinance transfer taxes new york

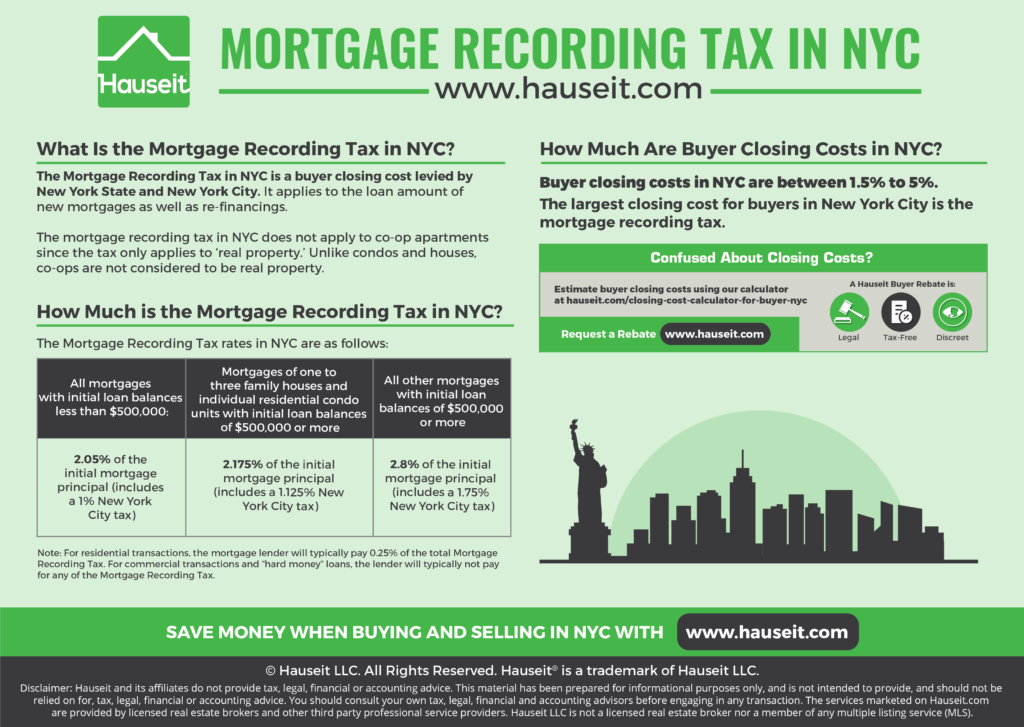

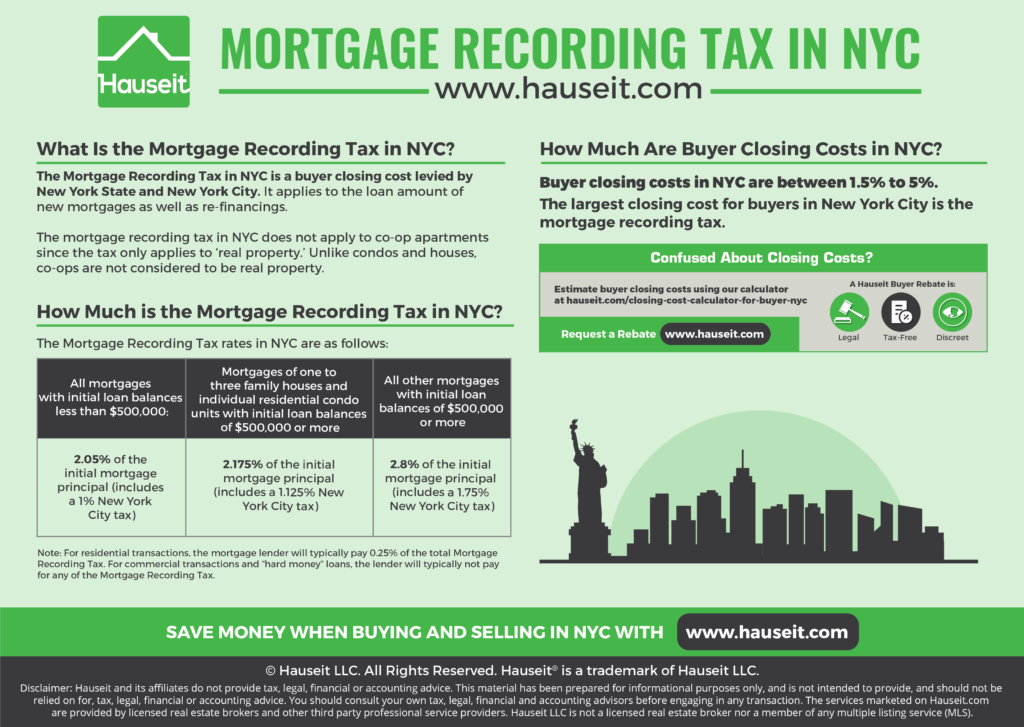

What is the real estate transfer tax rate in New York. The state charges a recording tax on new mortgage debt.

Closing Costs That Are And Aren T Tax Deductible Lendingtree

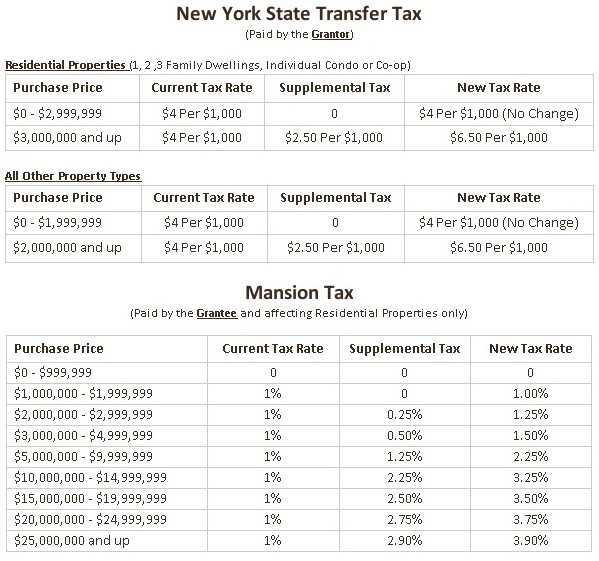

Additionally in 2019 NYS imposed an additional 025 transfer tax on all properties above 3 million.

. With a CEMA you pay 1925 and the lender pays 025. An additional tax of 1 of the sale price mansion tax applies to residences where consideration is 1 million or more. 10 year refinance rates ny mortgage refinance new york new york refinance tax best refinance rates new york cema refinance new york coop refinance new york new york refinance rates transfer.

Administrative fee for nondeed transfers. New York State equalization fee. Perhaps the best bet is refinance with the existing lender.

Transfer tax differs across the US. New York State also has a mansion tax. Check it out here.

The tax must be paid again when refinancing unless both the old lender and the new lender accept the Consolidation Extension Modification Agreement CEMA process. You will also be subject to New York State transfer taxes which is 04 of the sales price for properties below 3 million and 065 for properties over 3 million. Your transfer tax is equal to a percentage of the sale price or appraised value of the real estate that you buy or sell.

Potential fees for co-ops. 350000 x 18 6300. Locals generally call it 400 per thousand.

Including the mansion tax. Ad Traslados de los Aeropuertos de Nueva York a tu Hotel. An additional tax of 25 cents per 100 of the mortgage debt or obligation secured 30 cents per 100 for counties within the Metropolitan Commuter Transportation District.

The tax is usually paid as part of closing costs at the sale or transfer of property. That is usually the easiest way to not pay the tax. In New York State the transfer tax is calculated at a rate of two dollars for every 500For instance the real estate transfer tax would come to 1200 for a 300000 home.

If you buy a home in that price range the average closing. Pickup or payoff fee. You must pay the Real Property Transfer Tax RPTT on sales grants assignments transfers or surrenders of real property in New York City.

When there is a transfer of title to real property in New York there is a tax of 2 for every 500 of the sales price. Here is how the CEMA tax is calculated and how much you can save when you pay taxes on a condo with a sale price of 750000 a buyer loan size of 600000 an outstanding loan principal of 500000 and a mortgage recording tax rate of 2175. Title insurance rates are regulated by the State of New York therefore title insurance rates will be the same between title insurers.

On a refinance of a 385000 mortgage on a single-family home in Brooklyn the mortgage recording tax would be 6900 for the homeowner and 96250 for the new lender Mr. Lender Doesnt Pay any of the Mortgage Tax. The rate varies by county with the minimum being 105 percent of the loan amount.

New York Refinance - If you are looking for lower expenses then our services can help you improve financial situation. A supplemental tax on the conveyance of residential real property or interest therein when the consideration is 2 million or more. New York State transfer tax.

In many cases however a homeowner may be able to avoid the mortgage recording tax on a refinance if the original lender and the new lender cooperate. Basic tax of 50 cents per 100 of mortgage debt or obligation secured. Easily calculate the New Your title insurance rate and NY transfer tax.

Tax is computed at a rate of two dollars for each 500 or fractional part thereof of consideration. Residential Type 1 and. 1 to 3 of purchase price if applicable.

The rate is highest in New York City where borrowers pay. The New York City Department of Finance website has a mortgage tax calculator to help you figure out the tax. New York Refinance Aug 2022.

New York State also applies a 04 transfer tax on all properties. Add the extra 200 for the last fraction above the last thousand and youll be spot on. For homes with sales prices over 500000 the tax is 1425.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit Nyc Nys Transfer Tax Calculator For Sellers Hauseit A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo. Lender Pays Part of the Mortgage Recording Tax. 700000 Refinance Loan Amount.

Transfer tax on refinance in new york. For homes with sales prices over 500000 the tax is 1425. You must also pay RPTT for the sale or transfer of at least 50 of ownership in a corporation partnership trust or other entity that ownsleases property and transfers of cooperative housing stock shares.

If either one does not accept the process must be paid. Special additional tax of 25 cents per 100 of mortgage debt or obligation secured. Ad Traslados de los Aeropuertos de Nueva York a tu Hotel.

This calculator is designed for one to three family residential owner occupied homes. Thats a misnomer however. Lender Pays Part of the Mortgage Recording Tax.

New York City Property Original Mortgage. That means the NYS transfer tax will be either 04 or 065. New York charges a NYS mortgage tax or specifically a recording tax on any new mortgage debt.

Reducing Refinancing Expenses The New York Times

Real Property Transfer Tax Increase The Judicial Title Insurance Agency Llc

Refinancing Your House How A Cema Mortgage Can Help

Real Estate Transfer Taxes In New York Smartasset

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Is A Homestead Exemption And How Does It Work Lendingtree

Saving New York State Mortgage Recording Tax Gonchar Real Estate

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Are Real Estate Transfer Taxes Forbes Advisor

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit